Starting up a small business could be a great way to make a living. The available options for you are expanding and more individuals are taking advantage of this. Whether you are a single parent or a full time entrepreneur, there are opportunities for almost everybody.

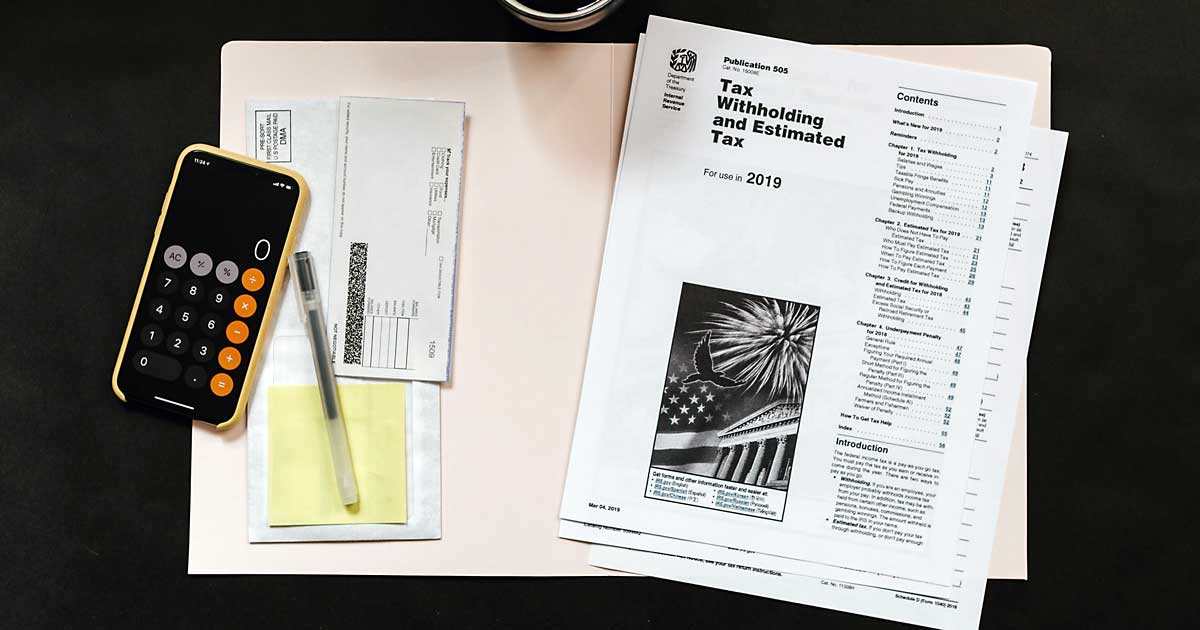

As we approach tax season, it’s essential that you become familiar with small business tax deductions.

In principle, this is a really simple idea.

The more legitimate tax deductions you can get, the more money you are able to put in your pocket.

You will find a number of different factors involved in this, so you will have to figure out what you will and will not qualify for. It’s worth becoming familiar with, as it can save you tons of money.

One on the many small business tax deductions some small business owners generally qualify for is automotive costs. If you used your personal car for business purposes, it might qualify for deductions. Keep a record of your business uses separate from person use because personal use will not qualify. Consider the expense of the repair and maintenance that may qualify for exemptions as these deductions can really add up.

In general, many day to day business costs might qualify. Your advertising budget for the year might be valid. Also take into account your utility costs and other repairs that were necessary to your home office. There are many things you might qualify for, so look into this intensely.

You may discover that some of your travel expenses are tax deductible too. It’s advisable to keep track of your travel costs, which include everything from plane fare to lodging. Know that, even if you combine your organization trips with pleasure, you might still qualify. That is, if the primary purpose of the trip is business-related.

This is only a brief look at some of the more easily deductible taxes you may qualify for. Other aspects to consider are specialized equipment you might have had to purchase and moving costs. Also think about charitable contributions. These deductions can be passed on to you and may be claimed on your individual tax return. Explore this well and take it seriously, there are numerous ways to save money come tax season.

Here is the business I recommend. It’s a Savings Club with an all digital product that can save money for anyone. Exclusive to our fastest growing team is a complete marketing system at no cost to you.